Carl Menger (1840-1921)

Carl Menger is widely regarded as the founder of the Austrian School of Economics, establishing its core principles through his seminal work, Principles of Economics, published in 1871.

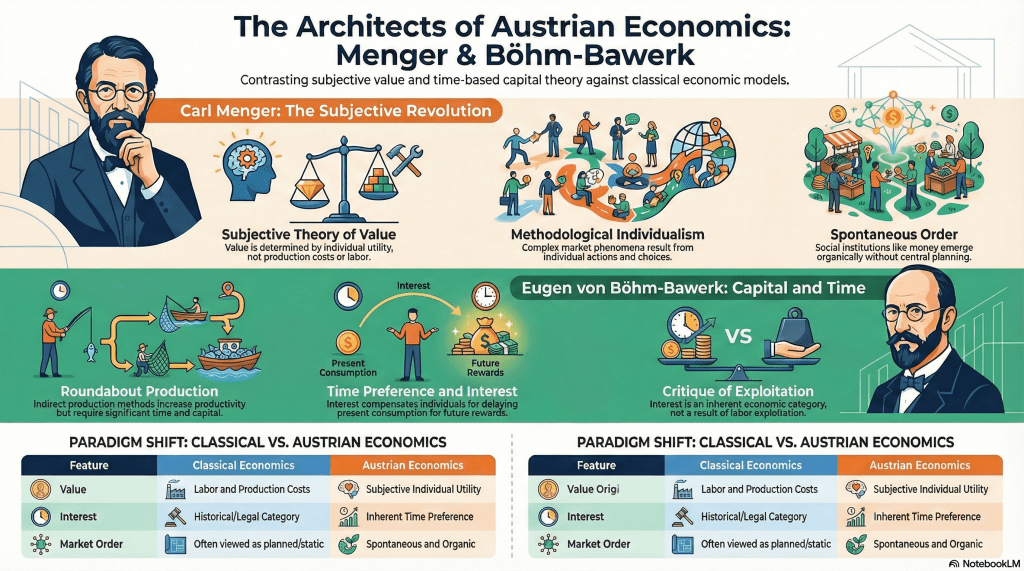

Figure 30: Carl Menger

Source: https://commons.wikimedia.org/wiki/File:Carl_Menger_Portrait_ONB_cropped.png

His ideas marked a significant departure from classical economics, emphasizing individualism and subjective elements in economic analysis.

Subjective Theory of Value: Menger argued that the value of goods is not inherent or determined by production costs (as in labor theories of value), but rather subjective, based on the utility or satisfaction an individual derives from them. Goods exchange because individuals value them differently, leading to mutually beneficial trades.

| On the subjective character of the measure of value In his book “Principles of Economics” (1871), Menger wrote: “When I discussed the nature of value, I observed that value is nothing inherent in goods and that it is not a property of goods. But neither is value an independent thing. There is no reason why a good may not have value to one economizing individual but no value to another individual under different circumstances. The measure of value is entirely subjective in nature, and for this reason a good can have great value to one economizing individual, little value to another, and no value at all to a third, depending upon the differences in their requirements and available amounts. What one person disdains or values lightly is appreciated by another, and what one person abandons is often picked up by another. While one economizing individual esteems equally a given amount of one good and a greater amount of another good, we frequently observe just the opposite evaluations with another economizing individual. Hence not only the nature but also the measure of value is subjective. Goods always have value to certain economizing individuals and this value is also determined only by these individuals. The value an economizing individual attributes to a good is equal to the importance of the particular satisfaction that depends on his command of the good. There is no necessary and direct connection between the value of a good and whether, or in what quantities, labor and other goods of higher order were applied to its production. A non-economic good (a quantity of timber in a virgin forest, for example) does not attain value for men if large quantities of labor or other economic goods were applied to its production. Whether a diamond was found accidentally or was obtained from a diamond pit with the employment of a thousand days of labor is completely irrelevant for its value. In general, no one in practical life asks for the history of the origin of a good in estimating its value, but considers solely the services that the good will render him and which he would have to forgo if he did not have it at his command. Goods on which much labor has been expended often have no value, while others, on which little or no labor was expended, have a very high value. Goods on which much labor was expended and others on which little or no labor was expended are often of equal value to economizing men. The quantities of labor or of other means of production applied to its production cannot, therefore, be the determining factor in the value of a good. Comparison of the value of a good with the value of the means of production employed in its production does, of course, show whether and to what extent its production, an act of past human activity, was appropriate or economic. But the quantities of goods employed in the production of a good have neither a necessary nor a directly determining influence on its value.“ |

Marginal Utility Revolution: As a co-founder of this concept, Menger explained that economic decisions are made at the margin—meaning individuals assess the additional benefit of one more unit of a good. This diminishing marginal utility helps explain price formation and resource allocation.

Methodological Individualism: Menger advocated that economic phenomena should be understood through the actions and choices of individuals, rather than aggregate or collective entities. This approach forms the basis for analyzing complex social outcomes from simple individual behaviors.

Spontaneous Order: He theorized that many social institutions, including money and markets, emerge organically from individual interactions without central planning, evolving through trial and error to solve coordination problems.

| On Spontaneous Order In his book “INVESTIGATIONS INTO THE METHOD OF THE SOCIAL SCIENCES WITH SPECIAL REFERENCE TO ECONOMICS” (1883), Menger wrote: “How can it be that institutions which serve the common welfare and are extremely significant for its development come into being without a common will directed toward establishing them? (…) The remark is hardly needed that the problem of the origin of unintentionally created social structures and that of the formation of those economic phenomena that we have just mentioned exhibit an extremely close relationship. Law, language, the state, money, markets, all these social structures in their various empirical forms and in their constant change are to no small extent the unintended result of social development. The prices of goods, interest rates, ground rents, wages, and a thousand other phenomena of social life in general and of economy in particular exhibit exactly the same peculiarity. Also, understanding of them cannot be “pragmatic” in the cases considered here. It must be analogous to the understanding of unintentionally created social institutions. The solution of the most important problems of the theoretical social sciences in general and of theoretical economics in particular is thus closely connected with the question of theoretically understanding the origin and change of organically” created social structures.” |

Menger’s work laid the theoretical foundation for Austrian economics, influencing later thinkers by shifting focus to human action, uncertainty, and market processes.

Eugen von Böhm-Bawerk (1851-1914)

Eugen von Böhm-Bawerk, a student of Menger, advanced the Austrian School by building on its subjective foundations, particularly in the areas of capital, interest, and time in economic processes. He served as Austria’s Minister of Finance and was a prominent critic of socialist theories.

Figure 31: Eugen von Böhm-Bawerk

Source: https://commons.wikimedia.org/wiki/File:Eugen_von_B%C3%B6hm-Bawerk_1896_Portrait_cropped.png

His major contributions appear in works like Capital and Interest (1884-1889) and The Positive Theory of Capital (1889).

Theory of Capital and Roundabout Production: Böhm-Bawerk viewed capital not as a homogeneous stock but as heterogeneous goods produced through time-consuming, “roundabout” methods. Roundabout production refers to indirect, time-consuming processes where resources are first invested in creating intermediate capital goods (tools, machinery, or infrastructure) before producing final consumer goods. In contrast to direct production, which involves immediate transformation of resources into consumables without intermediaries. More indirect production processes (e.g., using tools to make goods) yield greater productivity, but require waiting and forgoing immediate consumption. This time element is central to understanding economic growth and the structure of production.

Time Preference and Interest Rates: He explained interest as arising from individuals’ preference for present goods over future ones (positive time preference). Interest compensates for the delay in consumption, and its rate is determined by the interplay of time preferences, productivity of capital, and market forces. This theory links interest to real economic factors rather than exploitation.

| Interest nature In his book “THE POSITIVE THEORY OF CAPITAL“, Böhm-Bawerk wrote: “Thus we come to a very remarkable and noteworthy result. Interest, which today the Socialists abuse as a gain got by exploitation, a robbery from the products of labour, would not disappear even in the Socialist state, but would remain, in promise and potency, as between the community organised under Socialism and its labourers, and must so remain. The new organisation of society may make some change in the persons who receive it, and in the shares into which it is divided, by altering the relations of ownership; but the fact that the owners of present commodities, in exchanging them for future commodities, obtain an agio, it neither will nor can alter. And here, again, it is shown that interest is not an accidental ” historico-legal” category, which makes its appear ance only in our individualist and capitalist society, and will vanish with it; but an economic category, which springs from elementary economic causes, and therefore, without distinction of social organisation and legislation, makes its appearance wherever there is an exchange between present and future goods. (…)“ |

Critique of Exploitation Theories: Böhm-Bawerk famously critiqued Karl Marx’s labor theory of value and exploitation arguments, showing inconsistencies in how surplus value is derived and emphasizing the role of time and capital in value creation.

Business Cycle Insights: His ideas on mismatched capital investments (e.g., due to artificially low interest rates) foreshadowed Austrian business cycle theory, where malinvestments lead to booms and busts requiring painful readjustments.

Böhm-Bawerk’s emphasis on time, intertemporal choices, and the dangers of interfering with market signals strengthened the Austrian framework, influencing debates on monetary policy and economic planning.

Questions for reflection

1. How does Menger’s subjective theory of value challenge the classical labor theory of value, and what implications does this have for understanding consumer behavior in modern markets?

2. Reflect on Menger’s idea of methodological individualism: How does reducing economic phenomena to individual actions help in analyzing complex social outcomes like market equilibria?

3. Menger argued that institutions like money emerge spontaneously without central planning. How does this apply to the rise of cryptocurrencies such as Bitcoin in the current digital economy?

4. In light of Menger’s spontaneous order, how could decentralized systems like blockchain challenge traditional state-controlled monetary systems in addressing current inflation issues?

5. Böhm-Bawerk’s insights on business cycles suggest booms from artificially low interest rates lead to busts. How does this apply to the Federal Reserve’s policies during the post-2020 economic recovery?

6. Menger’s emphasis on subjective value: How does this concept help evaluate the valuation of intangible assets like data and intellectual property in today’s knowledge economy?

Leave a comment